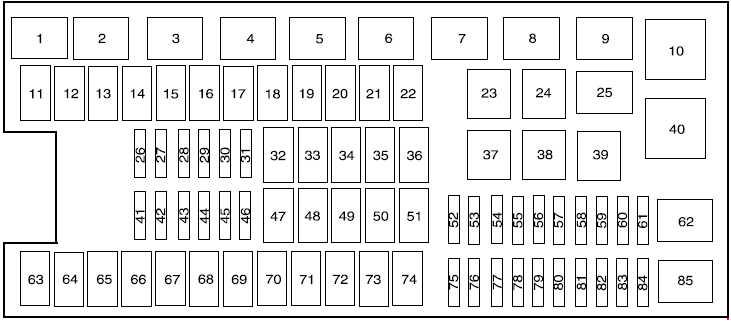

2005 Ford F 150 Fuse Diagram

- Category : Fuse Diagram

- Post Date : January 27, 2026

2005 Ford F 150 Fuse Diagram

Diagram 2005 Ford F 150 Fuse Diagram

Download 2005 Ford F 150 Fuse Diagram

A state panel on Wednesday gave the go ahead to a ballot measure that seeks to change Colorado’s flat rate of 4.41% to a graduated income tax, beginning in 2027, and raise billions dollars in new revenue.

Proponents hoping to change Colorado’s income tax structure from a flat rate to graduated tiers — thereby raising taxes for some brackets — walked away from a Wednesday meeting with eight ballot measures approved by the title board.

DENVER, CO — September 3, 2025 — The Protect Colorado’s Future coalition today announced plans to put a graduated income tax on the 2026 ballot. This proposal would lower taxes for 98 percent of Coloradans, while raising taxes on individuals and corporations making more than $500,000 a year.

The CEA proposal, which would raise the state spending cap set by the TABOR Amendment in the state constitution, likely faces an easier path to the ballot than the graduated income tax proposal. TABOR, which Colorado voters adopted in 1992, restricts growth in government using a formula that factors in population growth and inflation.

Proposed Initiative 181 would replace Colorado’s flat income tax with a so called “progressive” tax where taxpayers are charged higher rates based on their income.

Colorado Democrats are addressing a projected $750 million budget shortfall by enacting immediate legislation and proposing a graduated income tax amendment for the 2026 ballot. Legislative measures include eliminating certain tax breaks and adjusting reserve funds.

Now, nearly four decades later, a ballot measure campaign dubbed “Protect Colorado’s Future” (PCF) is seeking to move the state back to a progressive income tax system.

A Colorado election board gave proponents of a graduated income tax the OK for a third time Wednesday to move ahead with an initiative that’s proposed for the 2026 ballot — and members of the coalition said they’ve made enough changes to make this approval stick.

Even after three strikes, advocates for a “progressive” income tax aren’t out. Their proposal to replace Colorado’s 4.4% flat income tax rate with an array of tax brackets is once again ...

Proponents hoping to change Colorado’s income tax structure from a flat rate to graduated tiers — thereby raising taxes for some brackets — walked away from a Wednesday meeting with eight ballot measures approved by the title board.

3 way switch,3 way switch wiring,3 way switch wiring diagram pdf,3 way wiring diagram,3way switch wiring diagram,4 prong dryer outlet wiring diagram,4 prong trailer wiring diagram,6 way trailer wiring diagram,7 pin trailer wiring diagram with brakes,7 pin wiring diagram,alternator wiring diagram,amp wiring diagram,automotive lighting,cable harness,chevrolet,diagram,dodge,doorbell wiring diagram,ecobee wiring diagram,electric motor,electrical connector,electrical wiring,electrical wiring diagram,ford,fuse,honeywell thermostat wiring diagram,ignition system,kenwood car stereo wiring diagram,light switch wiring diagram,lighting,motor wiring diagram,nest doorbell wiring diagram,nest hello wiring diagram,nest labs,nest thermostat,nest thermostat wiring diagram,phone connector,pin,pioneer wiring diagram,plug wiring diagram,pump,radio,radio wiring diagram,relay,relay wiring diagram,resistor,rj45 wiring diagram,schematic,semi-trailer truck,sensor,seven pin trailer wiring diagram,speaker wiring diagram,starter wiring diagram,stereo wiring diagram,stereophonic sound,strat wiring diagram,switch,switch wiring diagram,telecaster wiring diagram,thermostat wiring,thermostat wiring diagram,trailer brake controller,trailer plug wiring diagram,trailer wiring diagram,user guide,wire,wire diagram,wiring diagram,wiring diagram 3 way switch,wiring harness